We're the easiest way to track your farm cashflow and manage your farm business.

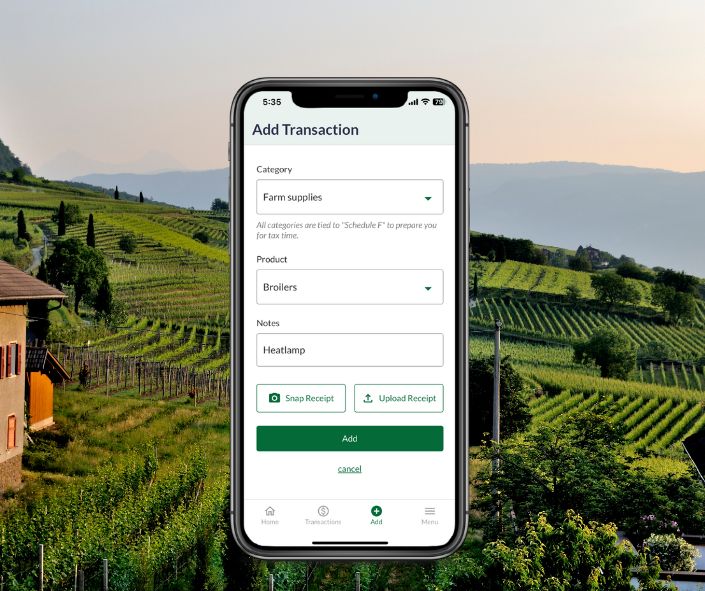

Snap receipts and tag transactions by Schedule F categories so you’re ready to apply for funding or export to your accountant. Our mobile app works great offline and in the field.

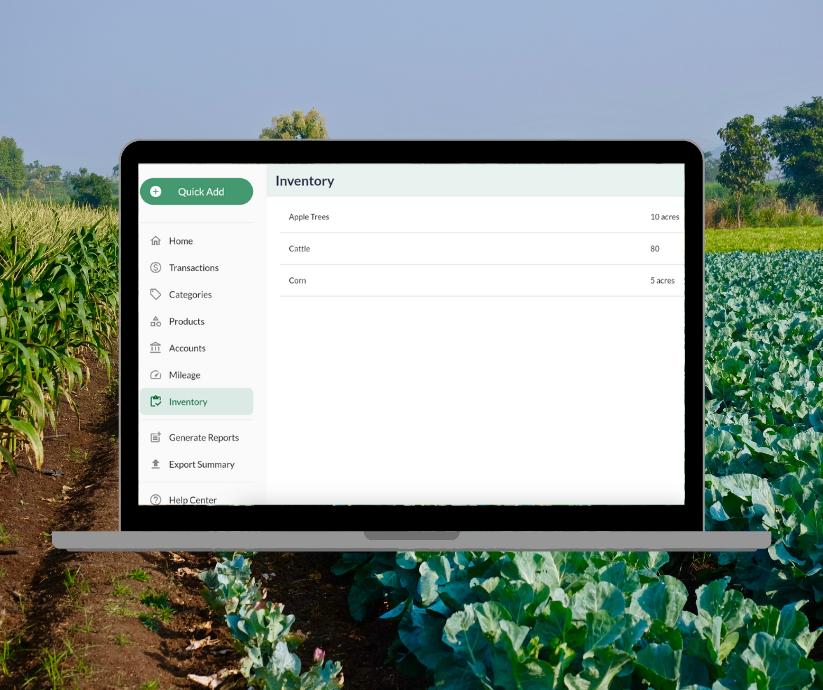

We know that keeping your inventory organized and up to date is essential for your farm business' growth. Our app allows you to keep track of your inventory in one place.

With our Tracks app, you can input expenses and income directly from your phone in seconds. You'll be able to generate a profit and loss for every major farm project.

Tell us about your operation, and we'll give you an assessment of your farm's financial health!

Looking to maximize your tax savings? You're in the right spot! We've compiled a comprehensive list that highlights farm specific tax write-offs just for you.